22+ ri paycheck calculator

Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Salary Paycheck Calculator Rhode Island Paycheck Calculator Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

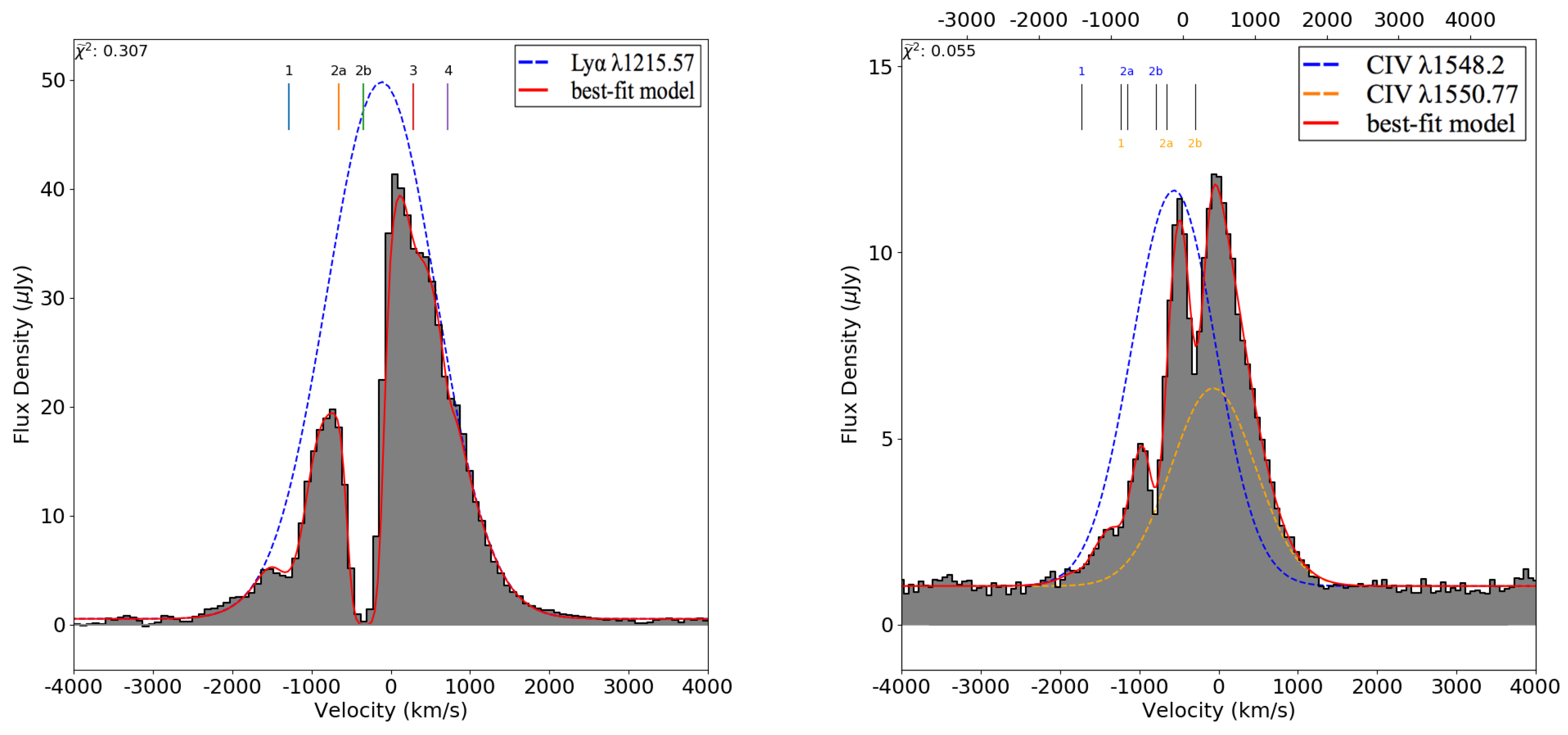

Galaxies Free Full Text Challenges And Techniques For Simulating Line Emission Html

Your average tax rate is 1198 and your.

. The tax rates vary by income level but are the same for all taxpayers. Overview of Rhode Island Taxes. For example if an employee earns 1500 per week the individuals annual.

Simply enter their federal and state W-4 information. We designed a handy payroll calculator to ease your payroll tax burden. Payroll pay salary pay check.

Supports hourly salary income and multiple pay frequencies. Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Rhode Island. Rhode Island has a progressive state income tax system with three tax brackets.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. All you need to do is enter wages earned and W-4 allowances for each of your employees. Rhode Island Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Rhode Island Income Tax Calculator 2021.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Back to Payroll Calculator Menu 2013 Rhode Island Paycheck Calculator - Rhode Island Payroll Calculators - Use as often as you need its free. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Net income Payroll tax rate Payroll tax liability Step 6 Minus everything Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every.

Take Home Paycheck Calculator Hourly Salary After Taxes

Rhode Island Salary Calculator 2022 Icalculator

Digital Terminal Year Book 2016 By Digital Terminal Issuu

Analysis Of Financial Time Series

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Us Paycheck Calculator Queryaide

Lineaeffe 2021 En By Oleg Kadnikov Issuu

Rhode Island Hourly Paycheck Calculator Gusto

Pdf Prion Diseases Neuromethods 129 Salvador Eduardo Acevedo Monroy Academia Edu

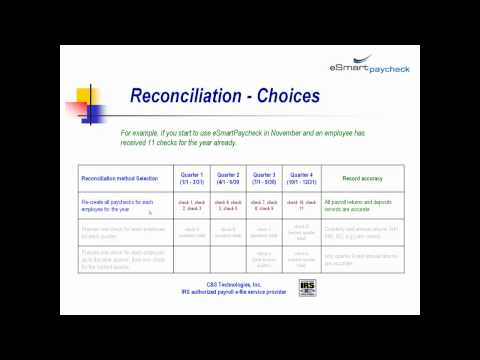

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Coade Pipe Stress Analysis Seminar Notes Pdf

Ilog Cplex 11 0 User S Manual

Rhode Island Paycheck Calculator Tax Year 2022

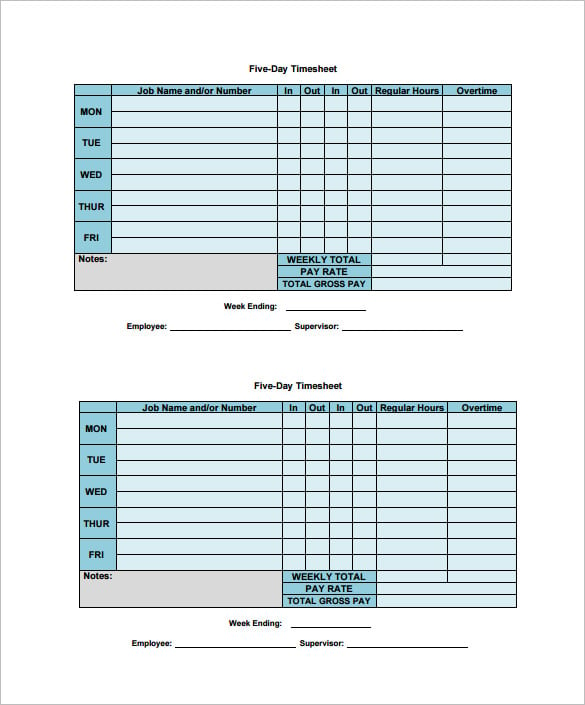

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Online Paycheck Calculator Calculate Take Home Pay 2022