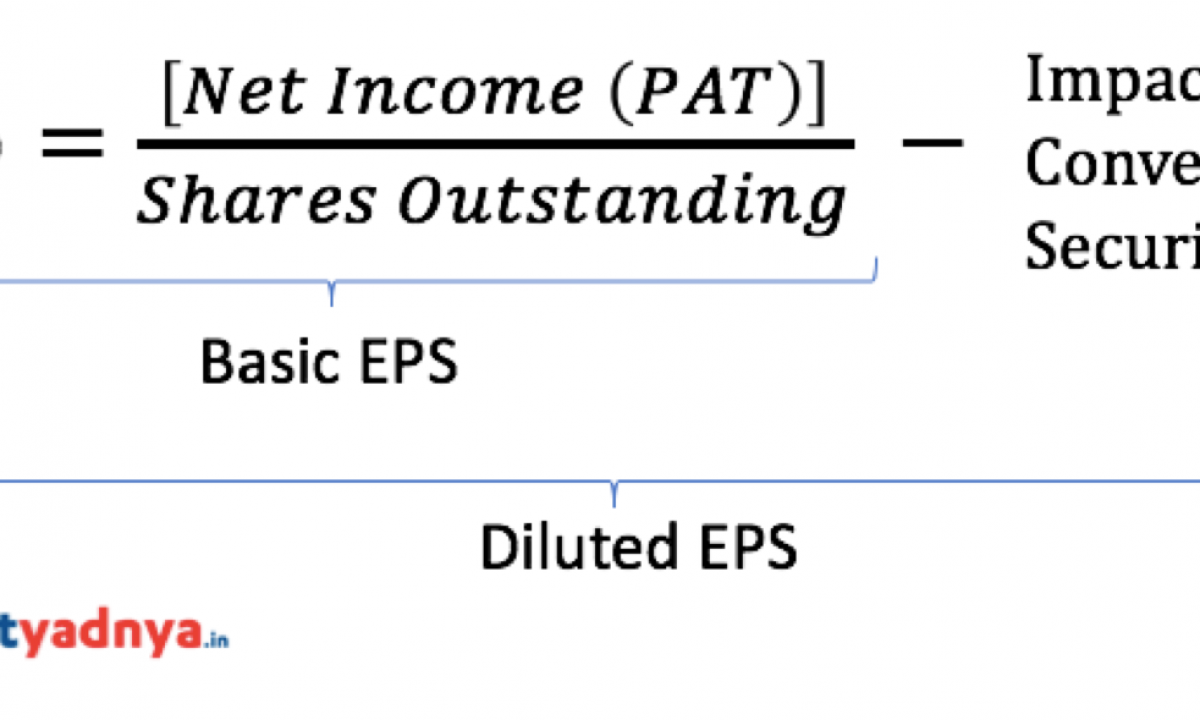

Diluted earnings per share formula

Here is an illustration of that calculation. Thus the formula for the average shares portion of the diluted earnings per share for this example would be 75 100 25 120 which would equal a weighted average of 105 common shares for the entire year.

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-02-46d614bf6401446d8a68276252797a11.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Ad Zacks Experts Just Revealed the Secrets Behind Making Money Using Earnings Reports.

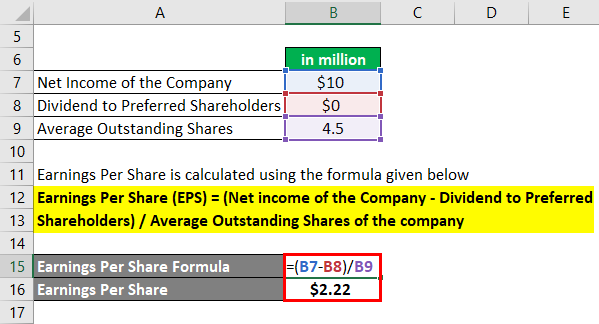

. Then you divide the 95 million by the 100 million shares outstanding. If the company had a net income of 50000 25000 in preferred dividends and 500000 outstanding shares the EPS would be calculated as 005. Our Updated Handbook Explains The Principles Of ASC 260 Through QAs And Examples.

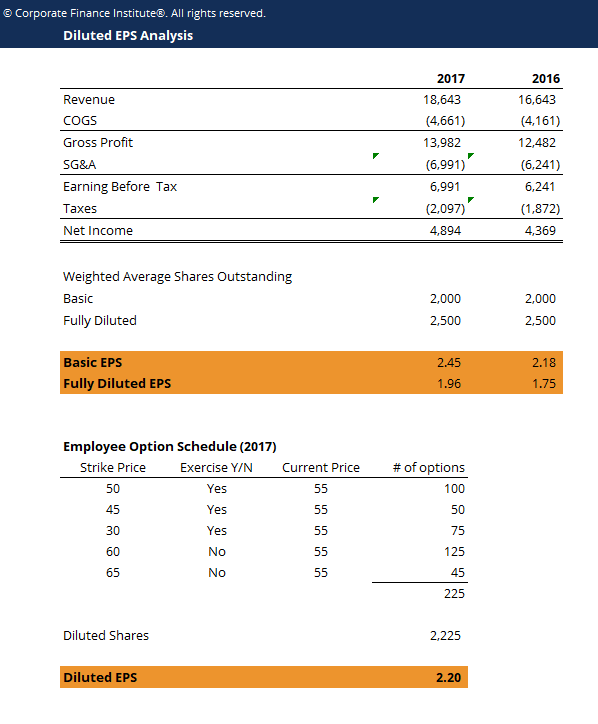

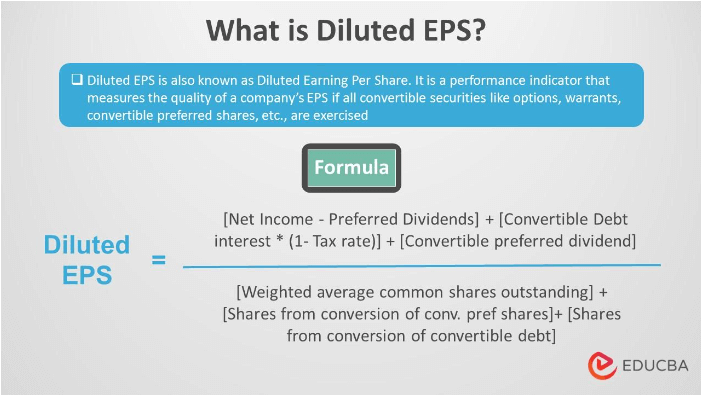

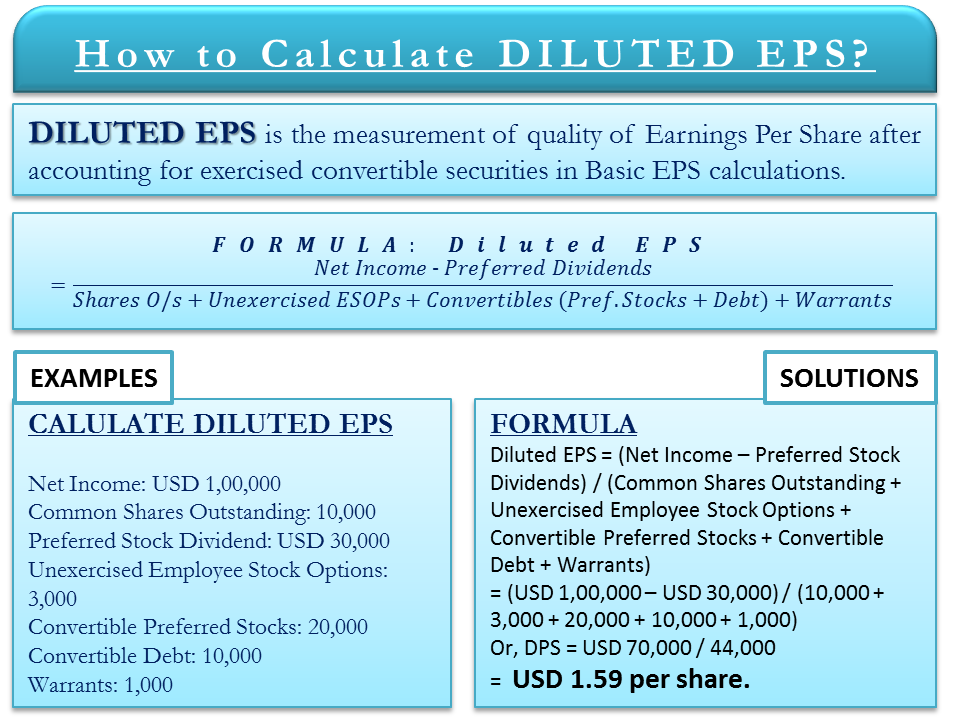

There are two different types of earnings per share. The diluted earnings per share EPS formula is equal to net income less preferred dividends divided by the total number of diluted shares outstanding basi. To calculate diluted EPS we start by adding those diluted shares 50 million 150 million 200 million to the 200 million outstanding shares to get a denominator of 400 million shares.

The formula for diluted earnings per share is a companys net income excluding preferred dividends divided by its total share count - including both outstanding and diluted shares. Diluted Earnings Per Share Formula. Ad Discussion And Analysis Of Significant Issues Related To Financial Statement Presentation.

Of Common Shares Outstanding Diluted EPS 1052 billion 066 billion 0 301 billion Diluted EPS 328 per share. Fully Diluted Common Shares Outstanding 200mm Common Shares 51mm 251mm We then divide the 250mm of net earnings for common equity by our new dilution-adjusted common share count to get our diluted EPS. The current years preferred dividends are subtracted from net income because EPS refers to earnings available to the common shareholder.

Reporting basic EPS is required because it increases the comparability of earnings between different companies. This represents 34s of a year and 14 of a year. The EPS would be calculated as 095 per share.

Earnings Per Share Formula Net Income Preferred DividendsWeighted Average Number of Shares Outstanding. You can calculate EPS using the formula given below. Common stock dividends are not.

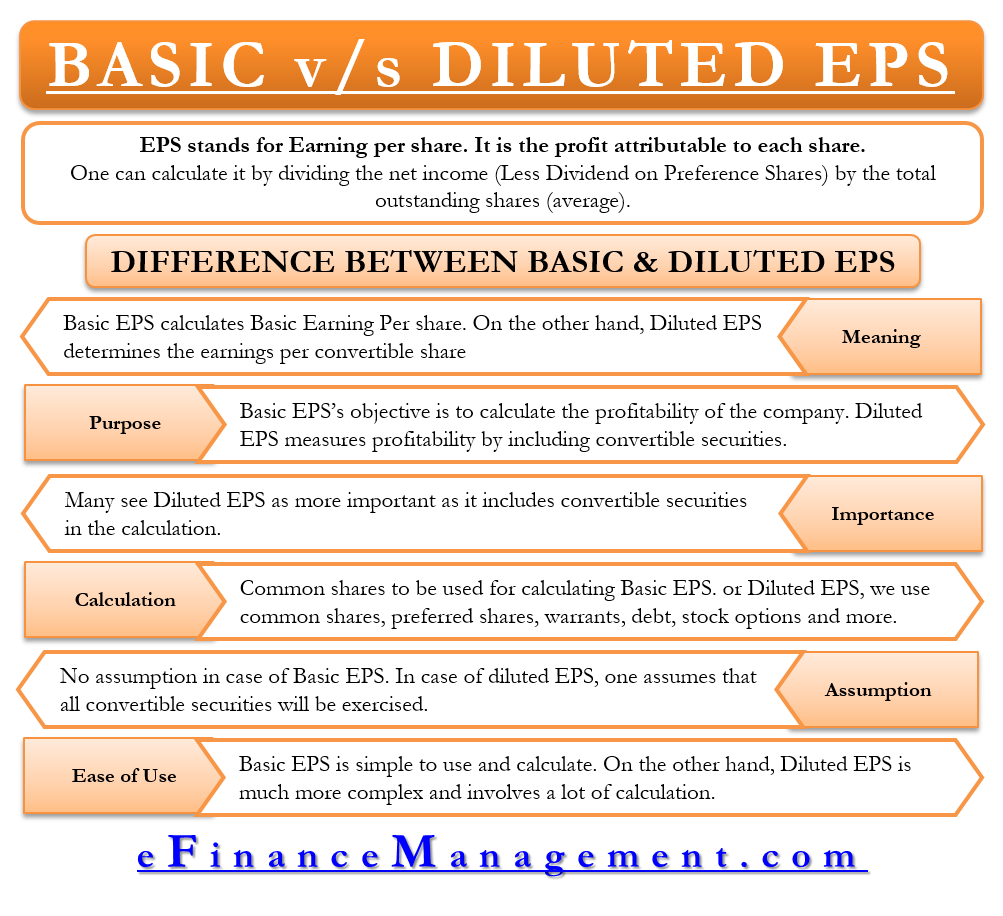

Capitalize on the Release of New Earnings Estimates. Fully diluted earnings per share assumes that any security that can be converted into common stock is converted and dilution increases the number of shares outstanding. The weights of 9 months and 3 months would be 75 and 25 respectively.

Watch the short video below to quickly understand the main concepts covered here including what earnings per share is the formula for EPS and an example of. Diluted EPS 250mm Net Earnings 251mm Fully Diluted Common Shares Diluted EPS 100. Profit or loss attributable to common equity holders of parent company After-tax interest on convertible debt Convertible preferred dividends Weighted average number of common shares outstanding during the period.

Get Your Free Report Now. This dilution may affect the profit or loss in the numerator of the dilutive earnings per share calculation. Earnings per share EPS is the portion of a companys profit allocated to each outstanding share of common stock.

EPS for a company with preferred and common stock net income. Calculating Diluted Earnings per Share. A diluted earnings per share example problem assumes that weighted average shares outstanding account includes securities that are dilutive.

Diluted Earnings Per Share is calculated using the formula given below Diluted EPS Net Income Paid to Non-Controlling Interest Paid out to Dilutive Securities Diluted Weighted Average No. To calculate diluted EPS take a companys net income and subtract any preferred dividends then divide the result by the sum of the weighted average number of shares outstanding and dilutive.

Diluted Eps Formula Example Calculate Diluted Earnings Per Share

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Basic Vs Diluted Eps All You Need To Know

Diluted Eps Prepnuggets

Earnings Per Share Formula Eps Calculator With Examples

Diluted Eps Earnings Per Share Meaning Formula Examples

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

What Is Dilutive Vs Antidilutive For Eps Universal Cpa Review

Share Dilution Meaning Calculation Example Diluted Eps Protection

Calculating Diluted Earnings Per Share

What Is Earning Per Share Eps Basic Vs Diluted Eps Yadnya Investment Academy

Calculation Of Diluted Eps Convertible Preferred Stock Finance Train

Simplifying Eps

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

How To Calculate Diluted Eps Formula Example Importance Efm